Another milestone has been reached by the technological behemoth Apple, which became the first publicly listed firm to end a trading day with a $3 trillion market valuation. Apple has transformed society with a lineup of goods that generate eye-popping revenues.

Another milestone was reached by Apple, the first publicly listed corporation to end a trading day with a $3 trillion market valuation. Apple is a technological behemoth that has transformed society with a portfolio of goods that generate staggering revenues.

Apple’s market capitalization increased to a $3 trillion market valuation on Friday as its shares increased 2.3% to settle at $193.97. A small group of technological firms, including Microsoft and chipmaker Nvidia, contributed to the S&P 500’s rise of about 16% in the first half of the year. Apple is one of these firms.

In January 2022, the 47-year-old business that Steve Jobs co-founded momentarily exceeded a $3 trillion market valuation on back-to-back days, but it was unable to maintain it by the time the market closed. Instead, amid a slowdown in growth and investor fears about increasing interest rates that hit the whole tech industry, Apple’s stock plunged into a protracted decline that briefly put its market value below $2 trillion early this year.

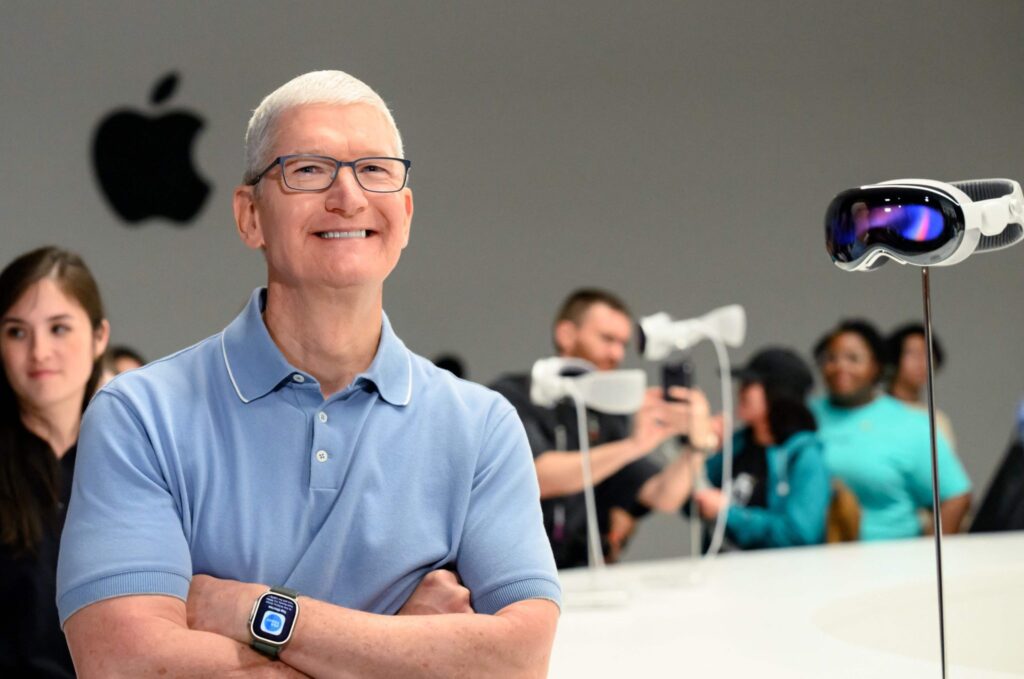

It wasn’t until earlier this month, when Apple introduced what may be its next major product, a pricey headgear called Vision Pro that immerses users in synthetic environments known as virtual reality, that the firm came near the $3 trillion market valuation mark once more.

Despite being primarily symbolic, having a market value of $3 trillion is nonetheless impressive due to its size.

Think about how roughly 9 million homes might be purchased in the United States with $3 trillion, according to Zillow’s calculation of the average sales price during the previous year. With lots of extra cash, it could also afford to purchase each of the top 50 sporting organizations in the world. Every American would earn nearly $9,000 if $3 trillion were divided evenly among all citizens.

At $2.5 trillion, Microsoft is the second-most valued public firm. The $2.08 trillion market value of oil behemoth Saudi Aramco The market capitalization of Alphabet, the parent company of Google, Amazon, and Nvidia, is above $1 trillion.

After surpassing $2 trillion for the first time in August 2021, almost two years after the Cupertino, California-based business topped $1 trillion for the first time, it took Apple less than two years to conclude with a $3 trillion market valuation.

The technological empire that Apple has developed since Jobs returned to the business in 1997 after being ousted by then-CEO John Sculley in 1985 is what has led to the cascading billions. When Jobs made his comeback, Apple was on the verge of going bankrupt and was so in need of assistance that it went to its formerly enmity competitor Microsoft for a financial injection.

Apple now generates so much money that it can pay out $105 billion in yearly investor dividends and stock repurchases while still having roughly $56 billion in cash at the conclusion of its most recent fiscal quarter.

The iPhone, which Jobs debuted in 2007 with his trademark theatrics, continues to be the jewel in Apple’s crown. More than half of the company’s roughly $400 billion in sales were attributed to the gadget in the previous year.

The remaining portion of Apple’s revenue comes from other products like the Macintosh computer, iPad, Apple Watch, AirPods, and a services division that offers music and video streaming, warranty services, fees from the iPhone app store, and advertising commissions from Google in exchange for being the iPhone’s default search engine.

Tim Cook, Apple’s current CEO, took over as CEO just before Steve Jobs passed away in October 2011, despite the fact that the majority of the company’s inventions were conceived while Jobs was in charge. Cook took over from Jobs when Apple’s market value was $350 billion.

READ ALSO – End of The Goldman-Apple Partnership? Takeover of Banking Services Being Discussed With American Express

According to reports, American Express is in discussions to take over the Apple credit card and other services, while Goldman Sachs is allegedly considering terminating its association with Apple.