Table of Contents

Apple, the creator of iPhones, is in discussions with banks and authorities to introduce its credit card, known as “Apple Card,” in India. Tim Cook, the company’s CEO, spoke with Sashidhar Jagdishan, the CEO and MD of HDFC Bank, on his trip to India in April, according to two people with knowledge of the situation.

According to a third source who spoke to Moneycontrol,

The tech giant is also in talks to possibly introduce Apple Pay in India with the National Payments Corporation of India (NPCI). It’s unclear from these talks if they pertain to its credit card, which uses NPCI’s Rupay network, or to UPI (Unified Payments Interface). Launching a Rupay Credit Card has the benefit that it may be connected to UPI as well.

This occurs at a time when a sizable portion of payments are increasingly being made via mobile devices. Aiming to expand into the payments industry, IT behemoths like Apple, Google, Amazon, and Samsung have big aspirations for the financial services industry. These businesses have created payment applications and aim to advance this field significantly.

According to information obtained by Moneycontrol, the Cupertino-based tech giant has also discussed the card’s parameters with the Reserve Bank of India (RBI). One of the sources stated above claims that the regulator has instructed Apple to follow the standard co-branded credit card procedure without providing the business with any preferential treatment.

The emails submitted to Apple and HDFC Bank received no responses from either company. Additionally, when asked via email if the regulator had spoken with Apple, the RBI did not answer. Moneycontrol’s text communications to NPCI went unanswered.

The sources claim that Apple is planning to introduce its Apple Card, a co-branded credit card with HDFC Bank, in the nation. The sources further said that the conversations are in their early stages and that no decision has been made. It was unclear what was being discussed or when Apple planned to introduce this in India.

According to one of the insiders, Apple was considering considerable departures from the typical co-branded credit card approach in India. The company’s willingness to make those concessions in order to introduce the card in India is unclear, the person continued.

Moneycontrol was unable to determine if Apple officials or its possible banking partner participated in the conversations with the regulator.

A premium credit card issued by Apple is presently available in the US. It was established in collaboration with Goldman Sachs and Mastercard. This card is marketed as a high-end item and is constructed of titanium metal.

“Apple only collaborates with the largest and greatest, which is why negotiations with HDFC Bank have taken place. Although there is a lot that goes into creating partnerships, one of the individuals cited above stated that banks and other companies would be eager to improve the conditions of the agreement in order to win over Apple.

Why India?

Apple has been focusing on India for the past few years, where sales of the iPhone are rising quickly despite starting from a low foundation. Around Rs 50,000 crore, or $6 billion, was Apple’s revenue in India in FY23, an increase of 50% over Rs 33,500 crore, or about $4 billion, in FY22. Apple generates over $80 billion in revenue from services worldwide. It would make a big difference if a sizable fraction of these transactions were converted to the Apple Card.

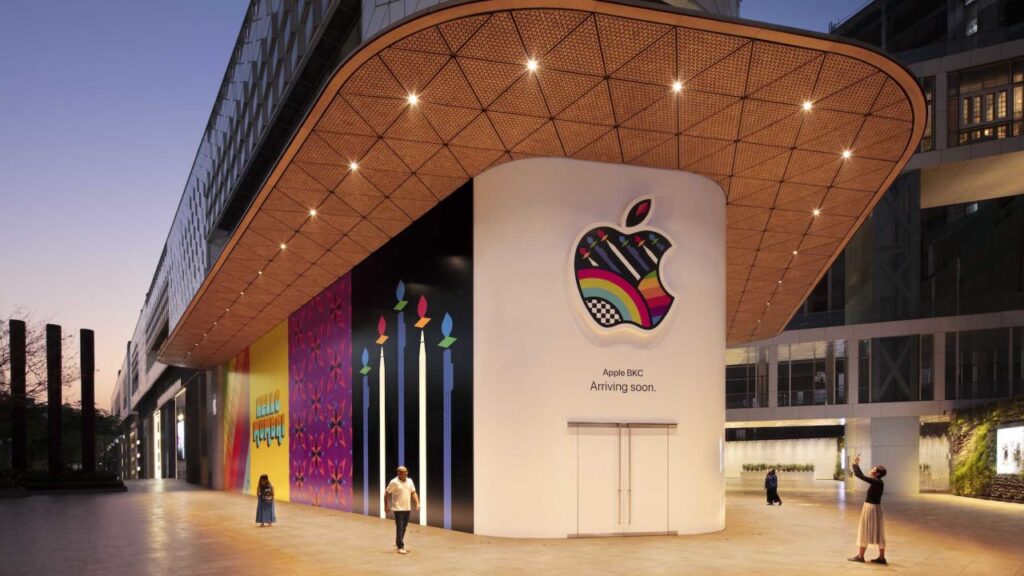

In Delhi and Mumbai, the business opened special retail locations during Cook’s April visit. Furthermore, the corporation has been moving a sizable chunk of its iPhone manufacturing to India, where it is possible that about 25% of Apple’s whole mobile phone production will be produced.

In India, where there are now two crore smartphone users, Apple has a roughly 4% share of the market. As in other middle-income nations, India might overtake the US and China as Apple’s third-largest market if 20–30% of smartphone users there migrate to the iPhone over the next ten years.

However, the fact that Apple does not presently take card payments in India may have pushed Apple to consider releasing the Apple Card there before Japan or other European nations. With the exception of iCloud services like storage and music, UPI manages the majority of App Store purchases in India.

“Apple is evasive on a few of these instructions. Therefore, the business decided to temporarily discontinue accepting card payments in India. In order to prevent the use of other credit cards on the site, it makes sense for the firm to consider creating its own credit card before it resumes card payments in India, according to one of the individuals stated above. According to the Apple website, the only accepted payment options on the platform are Apple Account Balance, net banking, and UPI.

Is Apple willing to make compromises?

Apple is unable to introduce a simple card with the customer’s name and the Apple logo on the front, as is the case in the US. According to the rules, Apple must take a backseat, and the bank must be the driver. On the back of the Apple Card in the US are also the names of Goldman Sachs and Mastercard. Additionally, there is no printed card number on the card. According to India’s current co-branded credit card restrictions, Apple cannot take these liberties there.

The RBI was quite explicit last year when it said that the bank’s partner could not hold customer or transaction data. Even Apple Card information cannot be saved on Apple systems, unlike in other nations where Apple operates.

What benefits does the Apple Card provide customers?

The reward money is transferred into Apple wallet and gets an annual interest rate of 4.15 percent thanks to the Apple Card’s integration with Apple Pay.

Additionally, there are no yearly fees for the Apple Card. Apple allowed cardholders in the US to pay for items with interest-free installments. The firm may collaborate with other premium brands to give 2-3% cashback or reward points on purchases from these partners in addition to the 3-5% cashback it now offers on Apple items and Apple services.

Apple also offers a daily 2 percent payback when using the card with an iPhone or Apple Watch in the US. This is accomplished by attaching the credit card to Apple Pay, and the payment is made by tapping and paying at payment terminals that support NFC (near-field communication). Additionally, the business offers 3 percent cashback at well-known retailers.

READ ALSO – LinkedIn Is Planning To Employ Generative AI More Often To Create And Publish Content

LinkedIn is currently developing a new tool that will let users publish content using generative AI. The AI chatbot will produce an early draft of the user’s post based on the minimum of 30 words that the user provides defining its primary concept.