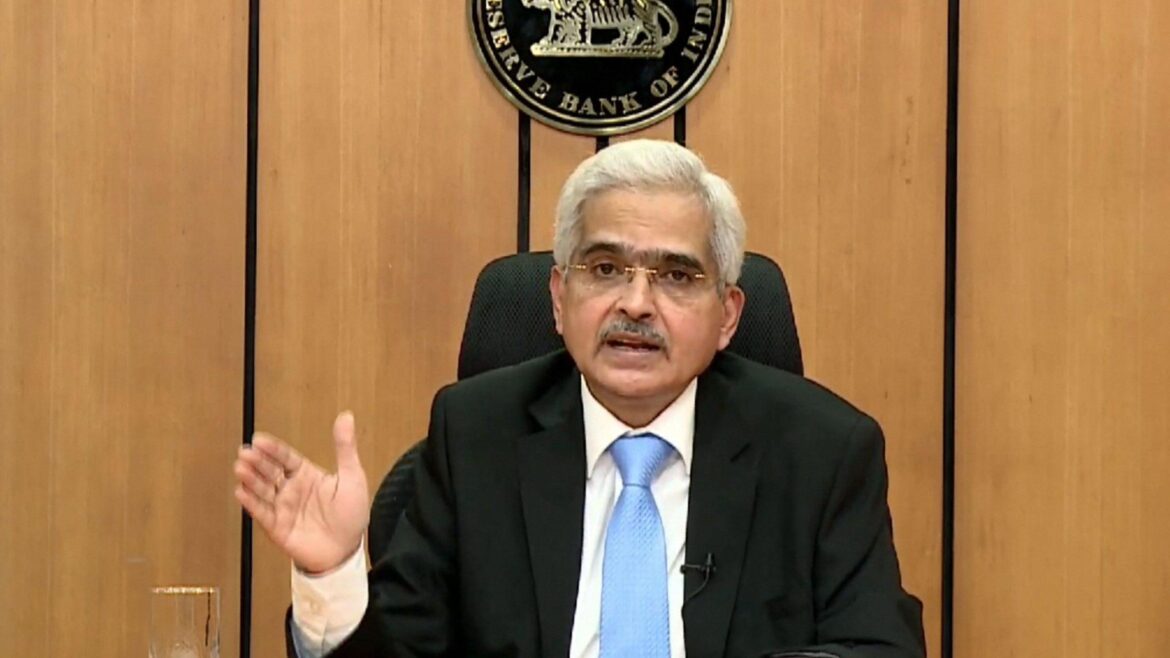

The Monetary Policy Committee of India left the repo rate same at 6.5% with the goal of removing accommodation in the policy stance. Risks are expected to be evenly distributed, with real GDP growth for 2023–24 forecast at 6.5%, with Q1 at 8.0%, Q2, 6.5%, Q3, and Q4 at 5.7%.

The RBI MPC 2023 Minutes was revealed on Thursday where there were six members of India’s monetary policy committee (MPC) who appeared to have increasingly different opinions on the direction of rate hikes in the future, with some external members warning that additional tightening could impede the economic recovery.

In the RBI MPC 2023 Minutes, independent member Jayant Varma stated that “monetary policies has gotten extremely close to limits beyond where it may cause substantial harm to the economy.”

The Monetary Policy Committee, or MPC, unanimously opted to maintain the repo rate at 6.5% earlier in June. MPC will continue to concentrate on eliminating the policy stance’s accommodation. RBI MPC 2023 Minutes, which were made public on Thursday, stated that real GDP growth for 2023–24 is predicted to be 6.5%, with Q1 growth of 8.0%, Q2 growth of 6.5%, Q3 growth of 6.0%, and Q4 growth of 5.7%, with risks being evenly distributed.

The important takeaways of RBI MPC 2023 minutes are listed below.

• World Economy

Despite continuing elevated but declining inflation, more difficult economic times, stress in the banking sector, and ongoing geopolitical crises, the global economy is maintaining its momentum in the second quarter of 2023.

In spite of the strengthening US dollar, sovereign bond rates are trading sideways as investors anticipate the tightening cycle’s impending climax. Since the last MPC meeting, equity markets are still range-bound. Risks to development prospects for some emerging market economies (EMEs) include weak external demand, high debt levels, and geoeconomic disintegration amid tighter external financial conditions, while capital flows are slowly returning to these countries on the back of increased risk appetite.

• Local economy

India’s real gross domestic product (GDP) development accelerated from 4.5 percent (year-over-year, y-o-y) in Q3:2022-23 to 6.1 percent in Q4, driven by fixed investment and greater net exports, according to preliminary estimates provided by the National Statistical Office (NSO) on May 31, 2023. In addition to the subsequent advance estimate of 7.0 percent, real GDP growth for 2022–2023 was estimated at 7.2%.

The first quarter of 2023–2024 will see domestic economic activity continue robust, according to high frequency indicators. The manufacturing purchasing managers’ index (PMI) reached a 31-month high in May, and the services PMI reached a 13-year high in April-May. Both indicators pointed to sustained expansion. National air passenger traffic, e-way bills, toll revenues and diesel consumption all showed strength in the services sector in April and May, whereas rail freight and port traffic only experienced minor growth.

Urban spending is still strong, as evidenced by indications like the sales of passenger cars and the increase in domestic air travel that occurred in April. Although unevenly, rural demand is progressively increasing. In April, motorbike sales increased but tractor sales decreased in part due to unseasonal rainfall.

The significant growth in April’s cement and steel consumption indicate that investment activity is starting up. While services exports continued their strong expansion in April, merchandise exports and non-oil, non-gold imports continued in contraction mode.

• Increase in CPI

On the strength of significant positive base effects, CPI inflation dropped substantially from 6.4% in February to 4.7% in April 2023, with softening seen across all three major groupings. Food group inflation decreased, with modest increases in the prices of cereals, eggs, milk, fruits, meat, and fish, as well as spices and prepared meals.

The deflation of edible oils continued to worsen. In the fuel category, kerosene prices entered deflation while LPG, firewood and chip prices experienced declining inflation. Clothing and footwear, home goods and services, health, transportation and communication, personal care, and impacts were the main drags on core inflation, which is the CPI inflation rate minus food and fuel.

From 1.4 lakh crore in February-March to 1.7 lakh crore in April-May, the average daily absorption under the LAF increased. As of May 19, 2023, the money supply (M3) has grown by 10.1% year over year and non-food bank credit by 15.6%. As of June 2, 2023, India’s foreign exchange assets were valued at US$ 595.1 billion.

Outlook

The direction of headline inflation in the future is probably going to be influenced by changes in food prices. In response to strong mandi arrivals and procurement, wheat prices may experience some correction. On the other hand, because of supply shortages and high fodder prices, milk prices are likely to continue to be under pressure. Although crude oil prices have decreased, the future remains unclear. The industrial, services, and infrastructure firms surveyed by the Reserve Bank anticipate a hardening of input costs and output prices, according to the early findings of the surveys.

Private spending and general economic activity should be supported in the present year by the increased rabi crop production in 2022–2023, the anticipated typical monsoon, and the ongoing buoyancy in services. Investment activity is anticipated to be nourished by the government’s emphasis on capital spending, a lowering of commodity prices, and solid credit expansion.

However, threats to the outlook include weak foreign consumer demand, geoeconomic disintegration, and persistent geopolitical instability. Real GDP growth for 2023–2024 is predicted to be 6.5%, with Q1 growth of 8.0%, Q2 growth of 6.5%, Q3 growth of 6.0%, and Q4 growth of 5.7%, with risks being evenly distributed.