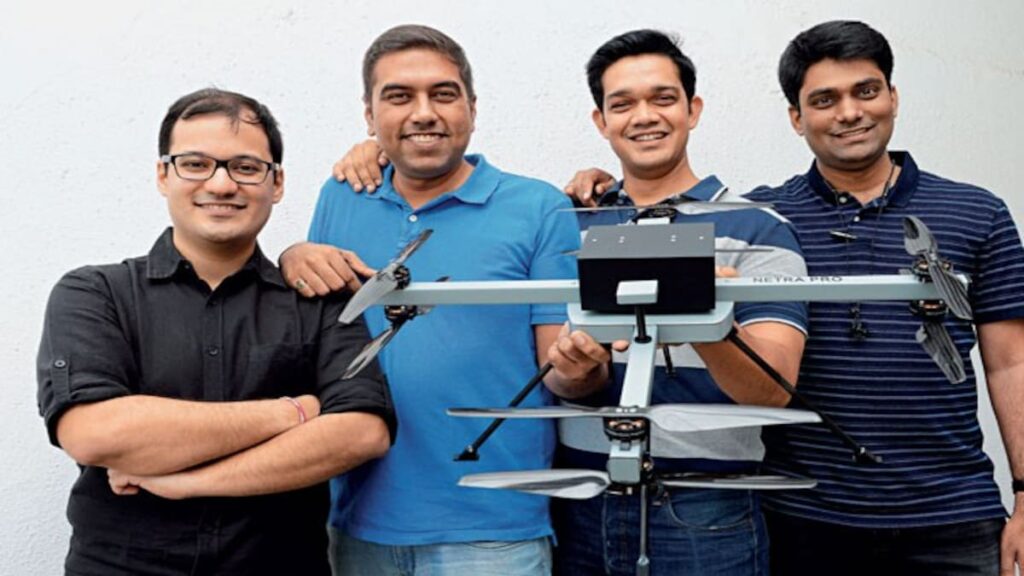

Ideaforge Technologies’ IPO, the largest drone manufacturer in India, will begin accepting subscriptions on June 26 for its Rs 567 crore ($76 million) initial public offering. The IPO will be open to public bids through June 29. On June 23, anchor investors will get their allocation. The IPO comprises a sale to stockholders of 48.6 lakh shares and a new issue of equity shares worth up to Rs 240 crore. The money obtained will be used for other general company purposes, including product development and debt reduction.

Ideaforge Technologies’ IPO will be available for subscription on June 26 and for public bids through June 29. On June 23, the distribution of funds for anchor investors will take place.

The price range was set by the corporation at Rs. 638–672 per share.

The size of the company’s issuance at the higher price band would be Rs 567 crore. The QIB part will receive 75% of the net offer (Rs 412-425 crore). 10% (Rs 55–57 crore) of the net offer (or Rs 82–85 crore) is set aside for NII, and 15% (Rs 82–85 crore) is set aside for retail.

In February of this year, the business submitted draft documents to the market regulator SEBI, and last month, those papers were approved.

The largest drone manufacturer in India, Ideaforge Technologies’ IPO, has received roughly Rs 60 crore in a pre-IPO round.

Institutional investors, including Tata AIG General Insurance, 360 One Asset Management, Motilal Oswal Mutual Fund, and Think Investments PCC, a foreign institutional investor, participated in the investment round.

The IPO consists of an offer for sale (OFS) of up to 48.6 lakh shares by selling stockholders and a fresh issue of equity shares up to Rs 240 crore.

The business has cut the new offering from Rs 300 crore to Rs 240 crore after the pre-IPO investment round.

As part of the OFS, Nambirajan Seshadri will sell 22,600 shares, Amarpreet Singh will sell 8,362 shares, and Ashish Bhat will sell 1,58 lakh shares. A&E Investment LLC, Agarwal Trademart Pvt. Ltd., and Celesta Capital II Mauritius are a few additional selling shareholders.

Rs 50 crore of the proceeds from its new issuance would be used for general corporate purposes, Rs 135 crore for supporting working capital needs, and Rs 40 crore for investment in product development. These funds will also be used to pay back some debt that the business has borrowed.

Customers that need applications for monitoring, mapping, and surveying are the main target market for IdeaForge. Along with other civil clients, it has clients from the military forces, the central armed police, state police agencies, disaster management forces, and forest departments.

One of the first few businesses to join the Indian UAV industry is this one.

Famous investors, including Infosys, Qualcomm, Celesta, Florintree, EXIM Bank, Indusage Technology Venture Fund, and Infina Finance, support the Mumbai-based business.

The book-running lead managers for the offer are JM Financial and IIFL Securities, while Link Intime India is the registrar.